You can save money and get the best deal among the various companies who provide car insurance. Reasonable ambulance charges for carrying the insured person, not exceeding Rs.2500 per insured person.Hospitalisation expenses along with room rent, OT charges etc.The policy is for factory owners /contractors/other commercial establishment looking for limited medical coverage.The policy covers hospitalisation expenses for accidents to the Workmen during the course of the employment.Optional sum insured of Rs.50,000 Rs.1 lac and Rs.1.5 lacs.Covers hospitalisation and other necessary expenses.Sum insured is between Rs.1 lac to Rs.Designed especially for the citizens between the age of 61 to 80 years.Sum insured is between Rs.1 lac to Rs.10 lac.Family discount of 5% on the total premium policy.Premium available for self, spouse, dependent children and dependent parents.Get exempt for income tax under section 80D.The cashless facility in more than 7000 hospitals.Covers hospitalisation expenses, room, boarding and nursing expenses.Sum insured is between rs.1 lac to rs.5 lacs in multiples of Rs.50,000.Children between 3 months to 18 years shall be covered.Beyond 60 years can be covered by the Gold policy.Entry age of this policy is 36 years and 60 years.The policy covers certain day care procedures.Policy covers hospitalisation expenses due to illness/disease/injury.

#United india insurance uni home care free#

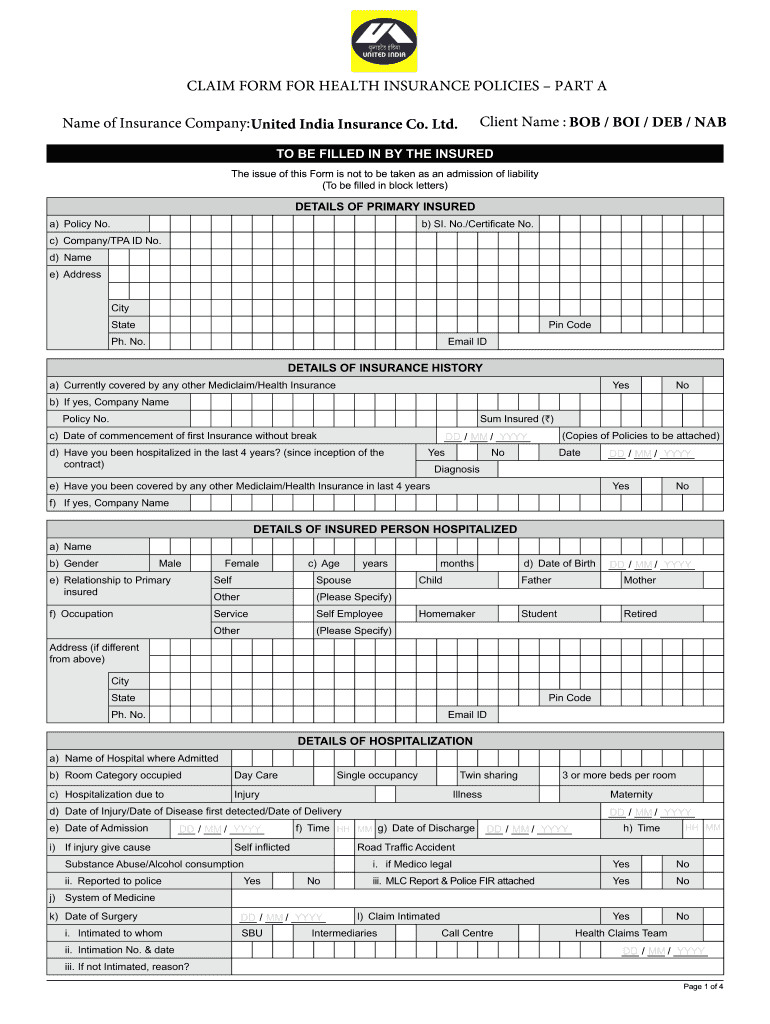

United India Insurance helps you to be a worry – free by choosing among their Unit various health policy options. The various policies by United India Insurance Co.Ltd, Health Insurance Policy With the wide array of product portfolio, United India Insurance is a reliable place to insure yourself, your family and property. While you do not know the unforeseen situation that might be waiting in near future, but you can carefully avoid it by keeping yourself and your family safe with a good insurance. There is no other company who has such a diverse product portfolio ranging from biogas and satellite. Since then it is providing a wide range of insurance products to the people as per their need. The United India Insurance companies merged with 12 Indian insurance companies, five foreign insurers, and four cooperative insurance companies to form the company. It was started on 18 th February 1938 and was nationalised in 1972. United India Insurance Company is owned by Government of India and it is the 2 nd largest general insurance company in the rank.

0 kommentar(er)

0 kommentar(er)